45l tax credit certification

The 45L credit is one of many benefits of the HERS rating. The leader in 45L Tax Credit certification support service including EnergyPro 45L software Raters services and free 45L plan reviews.

Understanding 179d Deductions And 45l Credits Lutz Accounting

Arkansas Home Builder sold 35.

. The 45L tax credit provides developers of energy efficient homes and apartment buildings up to 2000 per dwelling unit. 45 Knightsbridge Rd Piscataway NJ 08854 732 885-2930. Qualifying properties include apartments.

In late 2019 the tax credit was. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854. ENERGY STAR needs all.

The 45L Energy Efficient Homes Tax credit was recently extended through the Inflation Reduction Act. The good news is that you can go back and claim the 45L credit for properties that have been built or remodeled in the past three years. The 45L Energy-Efficient Home Tax Credit is equal to 2000 per residential unit or dwelling to the developers of energy-efficient buildings.

Website Take me there. 45Lc1A and B of the Internal Revenue Code. This notice also provides for a public list of software programs that may be used in calculating energy consumption for purposes of.

Browse reviews directions phone numbers and more info on Tax Credits LLC. Detailed energy analysis documents and reports can be provided including Energy Star certification. The Arkansas homes were built in Zone 3 to 2012 IRC minimum code and 2014 Arkansas Energy Code for New Building Construction.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. The leader in 45L Tax Credit certification support service including EnergyPro 45L software Raters services and free 45L plan reviews. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient.

We get it done. The 45L Tax certificate which. You are eligible for a property tax deduction or a property tax credit only if.

ENERGY CHECK has been certifying homes for the 45L Tax Credit in the United States since 2009. Claim this business 732 885-2930. REQUIREMENTS FOR TAX CREDIT.

Most projects built to 2016 and 2019 California energy code already. They are ESLM 578 Theory and Practice of. Heres who qualifies and how to get credits.

Next Up On 45l Federal Tax Credit Ducttesters Inc

Section 45l Tax Credit Energy Efficiency Tax Credit

45l Energy Efficient Home Tax Credit Extended For 2021 By Covid Relief Bill Green Building Law Update

What Is The 45l Tax Credit Cheers

John J Schultz Energy Consultant Resnet Hers Certified Rater Stevens Point Wisconsin Schultzenergyconsulting Com Ppt Download

The Homeowner S Guide To Ira Tax Credits And Pearl Certification

Federal Energy Tax Credits 45l Are Back Ducttesters Inc

Energy Tax Credit Energy Policy Act 2005 Tax Credits For Highly Efficient New Homes Tax Credits For Improvements To Existing Homes Tools Ppt Download

The 179d 45l Energy Tax Credits Offer Cash Flow Elb Consulting

Section 45l Tax Credit Rewards Developers Of Energy Efficient Homes Our Insights Plante Moran

45l Energy Efficient Home Credit Ics Tax Llc

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

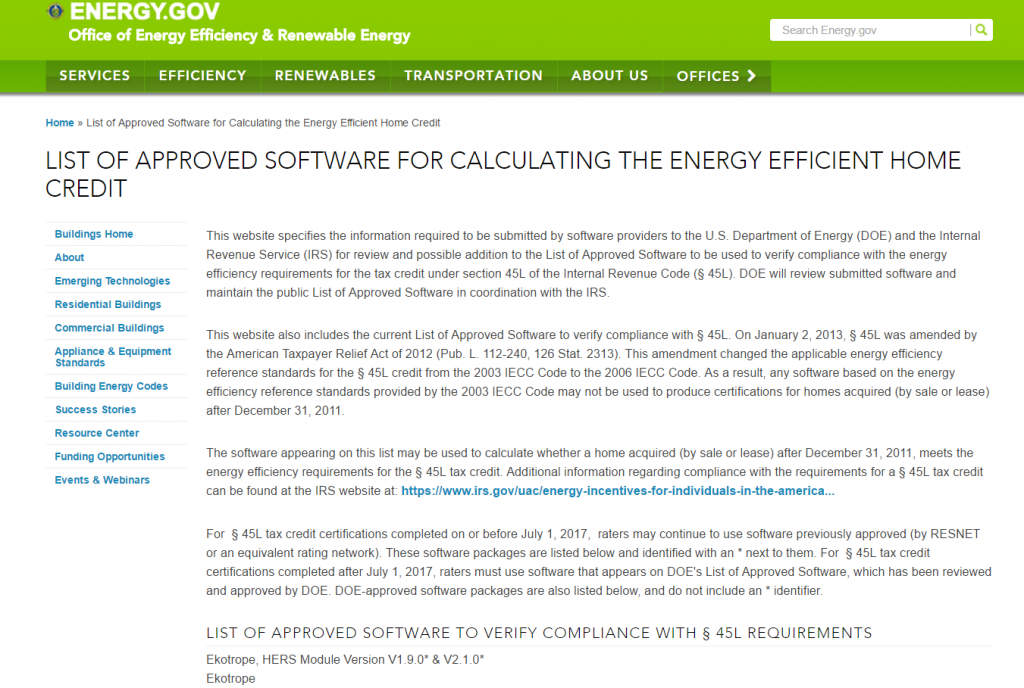

U S Department Of Energy To Approve Software Tools To Calculate Compliance To Federal 45l Tax Credit For Energy Efficient Homes Resnet No Longer Approves 45l Tax Credit Software Tools Resnet

Is It Too Late To Take Advantage Of The Section 45l Tax Credit Cost Segregation Authority

45l Tax Credit Energy Efficient Home Tax Credit Tax Point Advisors